foreign gift tax return

This due date gets extended. Unlike receiving a gift from a foreign person in which they do not have to identify the name of the donor if the gift came from a foreign business then the IRS wants to know the name of the foreign business.

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

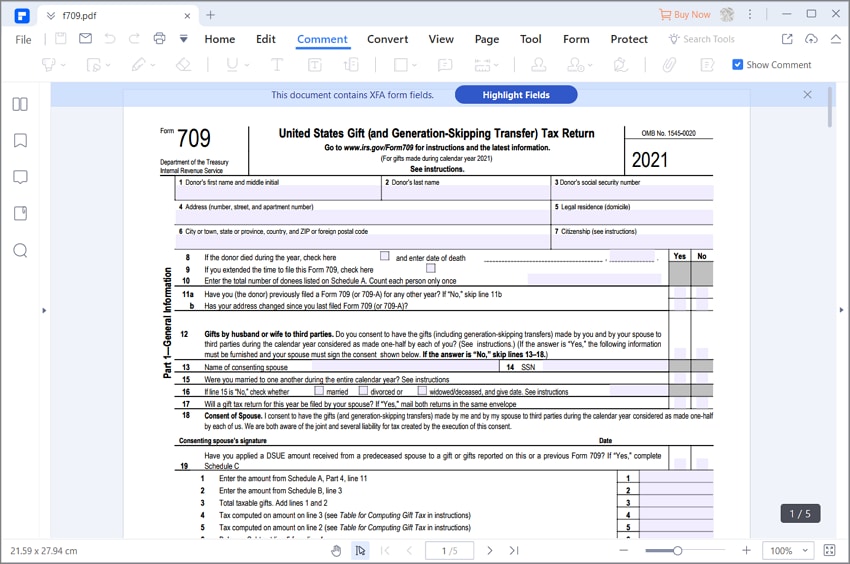

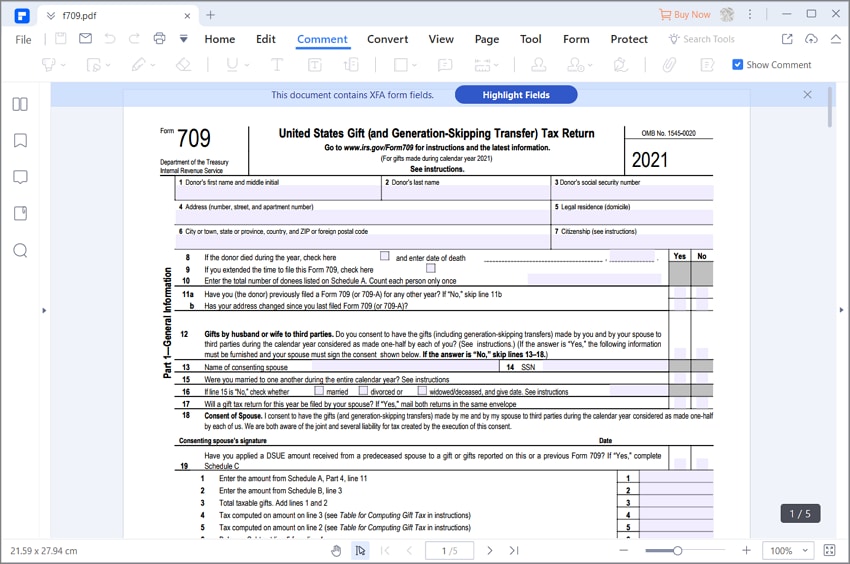

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Person resides in the US.

. The tax applies whether or not the donor intends the transfer to be a gift. Form 3520 This form is Annual Return to Report Transactions with Foreign Trusts Receipt of Certain Foreign Gifts. About Form 3520 Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

Therefore the IRS requires the recipient US. When IRS Form 3520 Is Due IRS Form 3520 should generally be filed by the 15th day of the fourth month following the end of the recipients tax year. Person must file IRS Form 3520 if they received a gift or bequest from a foreign person.

See sections 2501 a and 2511 b. Who Reports Gifts from Foreign Persons to the IRS. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

The IRS F orm 3520 is used to report a foreign gift inheritance or trust distribution from a foreign person. In simple terms a US. A common question our Tax Advisors get is How much money can you receive as a gift from overseas In reality there isnt a maximum amount of money you can receive as a gift from overseas but there is a threshold whichif you cross ityou need to report that gift to the IRS.

Form 3520 Instructions. The foreign person is a foreign individual corporation partnership trust. Taxpayer receives a gift from a foreign person trigger an international tax filing requirement.

Person must r eport the Gift on Form 3520. File Form 3520 each year you receive a foreign gift separately from your income tax return by following the directions in the Instructions to Form 3520. If you are a US.

Important Practice Tip If you receive a gift from Taiwan for Example of 600000 and your Dad needed 12 of their friends to each facilitate the transfer of 50000 due to currency restrictions this is still reportable. Person has to report the foreign gift. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts.

When it comes to the IRS international tax gifting rules of foreign persons to US persons it can get very complicated depending on the specific facts and circumstances of the transactionIn a common situation a US person Lawful Permanent Resident has foreign national non-resident parents who live abroad. This event triggers the requirement to file form 3520. However there are significant penalties for failure.

Declare foreign income and gains. Person receives a gift from a foreign person that meets the threshold for filing the US. As a result the person giving the gift files a gift tax return.

This value is adjusted annually for inflation. Decedents file Form 3520 to report. If the value of the foreign gifts received from a foreign corporation or partnership exceeds 16388 then the US.

In limited cases the IRS will waive the penalty if you show that you have reasonable cause for the failure. Use the SA106 supplementary pages when filing your SA100 Tax Return to. Once the 100000 threshold has been surpassed the recipient must separately identify each giftinheritance that is more than 5000.

Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. For a nonresident not a citizen of the United States the gift tax applies to the transfer by gift of certain US-situated property. Whether or not the US.

Limit on Income Tax reliefs. Person is required to report the gift on Form 3520. The form 3520 must be filed by the due date of US expat tax returns including extensions.

The value of the gifts received from foreign corporations or foreign partnerships must exceed 16815 as of tax year 2021. Person to file a form 3520 to report the gift. Nonresident Gift of US.

Show all amounts in US. Penalties for a Failure to file form 3520 The form 3520 to report gifts is for informational purposes only and there is no gifts tax due. All information must be in English.

If Part IV of Form 3520 is filed late incomplete or incorrect the IRS may determine the income tax consequences of the foreign gift. Recipients of foreign gifts. Form 3520 is due the fourth month following the end of the persons tax year typically April 15.

The Form 3520 complexity is on a sliding scale. Claim foreign tax credit relief. Property there may be a Form 3520 reporting requirement as well.

You make a gift if you give. The filing of Form 3520 is for reporting certain transactions with foreign trusts ownership of foreign trusts and receipt of certain large gifts or bequests from certain foreign persons. Persons and executors of estates of US.

Certain events such as when a US. It does not have to be a Foreign Gift Rather if a foreign person gifts US. If you are a nonresident not a citizen of the United States who made a gift subject to US.

Gift tax you must file a gift tax return Form 709 United States Gift and Generation-Skipping Transfer Tax Return when any of the following apply. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Certain transactions with foreign trusts.

Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than 100000 during the tax year. Real Estate Tax Implications. Ownership of foreign trusts under the rules of sections Internal Revenue Code 671 through 679.

You gave any gifts of future interests. Form 3520 is an information return not a tax return because foreign gifts are not subject to income tax. However there are some significant penalties for failing to.

In general the Form 3520 is merely an informational return as foreign gifts typically do not result in tax consequences for the taxpayer. You may receive a penalty equal to five percent of the value of the gift for each month the gift is not reported not exceeding 25 percent of the gift. 5 This value is adjusted annually for inflation.

Has no tax authority over the foreign person. Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts Go to wwwirsgovForm3520 for instructions and the latest information. Form 3520 for US.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Gift Tax And Other Exclusions Increases For 2022 Henry Horne

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Complying With New Schedules K 2 And K 3

Tax Cuts The Gift That Keeps Not Giving

How To Fill Out A Fafsa Without A Tax Return H R Block

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Gifts From Foreign Persons New Irs Requirements 2022

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

For How To Fill In Irs Form 709

Form 3520 Reporting Foreign Gifts Trusts And Inheritances H R Block

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

6 Surprising Facts Found In Presidential Tax Returns Through History History

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable