us exit tax calculation

Get Tax Compliant Today. The US exit tax applies to several different types of assets that may be owned by an expatriate and is calculated differently for each type.

Handy Tools For Expats Greenback S Us Expat Tax Calculator

Citizen or resident alien you are taxed on worldwide income.

. It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. 877A of the Internal Revenue Code Tax Responsibilities of Expatriation. Ad Never Filed Us Expat Taxes.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Your average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next. Status the IRS wants to be sure the person does not own any tax liability.

The US Exit Tax calculation is not straightforward especially when pensions are involved. If you are covered then you will trigger the green card exit tax when you renounce your status. This is a substantial amount and can be devastating if not handled correctly.

The exit tax law is found in IRC section 877A which liberally borrows from IRC section 877 the pre-2008 version of the exit tax law for definitions. University Eligible pension and whether the person had the pension from the University of Toronto ineligible pension. In some cases you can be taxed up to 30 of your total net worth.

Get professional tax help. In addition it requires individuals to certify to the IRS that they have. If you are a US.

Citizens for a period of 10 years following the date of expatriation and only if the alternative tax regime produces a higher tax liability than would have been imposed on the non-resident alien under 871 of the code. Amended IRC 877 creates objective criteria to impose the tax on individuals with an average income tax liability for the 5 prior years of 124000 for tax year 2004 127000 for tax year 2005 131000 for 2006 136000 for 2007 or 139000 for 2008 or a net worth of 2000000 on the date of expatriation. Even if their taxes are clean if a person.

Other countries have exit taxes too. These simplified single-issue examples are only for clarity. The general proposition is that when a US.

Zugimpex team will provide the best solution. Youre going to get taxed by the IRS on that US1 million gain. Ready for a free discovery call.

Note that you are required to pay the Exit Tax without having realized any income to pay the tax. Specified tax-deferred accounts including - IRA Roth IRA HSA 529 Plan Coverdell Education Savings Account Medical Savings Accounts. The IRS has published Notice 2009-85 Guidance for Expatriates Under Section 877A which amplifies some of the concepts of IRC section 877A.

This is called citizenship-based taxation. The amount is adjusted by inflation 2018s figure is 165000. Zugimpex team will provide the best solution.

Note that the amount refers to net income any deductions that reduce your tax burden reduces the net income figure Tax compliance. The United States is unique however in tying its exit tax to a change in visa or citizenship status. Before a person expatriates and gives up their US.

However according to the IRS interpretation the gain exclusion rule does not permit a straightforward reduction of the expatriates total gain. Tax compliant for 13 of the price with MyExpatTaxes. The US Exit Tax calculation is not straightforward especially when pensions are.

Solely for purposes of determining the exit tax property that was held by a nonresident alien on the day that individual. Special pro-rata allocations are required with regard to the various assets having built-in gain. Everything you need to become US.

The average annual net income that you are taxed on for the five years before you expatriate is more than a set amount. Who Can the IRS Subject To Exit Tax The US. For purposes of calculating the exit tax the built-in gain or loss of each asset is computed by subtracting the assets adjusted basis from the assets FMV id.

Put simply exit tax is an income tax. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax. Tax residents should note a special rule.

Ascend Your Way to Tax Compliancy. Any appreciation in excess of 690000 as of 2015 will be subject to the exit tax. We will summarise the Exit Tax and how Citizens Green Card Holders may be able to avoid it.

This theory is expressed in S. Under 877 the term alternative tax regime subjects the covered expatriate to tax on US-source income at rates applicable to US. The 9 parts are.

In order to calculate the amount of exit tax that you owe you need to file the form 8854 which is an expatriation statement that is attached to your final dual status return and works out the amount of money that you would earn on. Tax advantages for residents without domicile 5 corporate tax after refund. Ad Full service at one place.

We offer tax planning strategies to reduce or eliminate your tax liability. General Rule Expatriate and long-term residents. The United States is not alone in having an exit tax.

The Exit Tax calculates the tax the and makes you pay that tax as the price of relinquishing US. Currently net capital gains can be taxed as high as 238 including the net. Ad Full service at one place.

For the 2022 calendar year the exclusion amount is US767000. I further asked him to run different scenarios based on whether the relinquisher had a a pension from a US. The CPA graciously calculated the amounts to go on the Form 8854 and calculated the Exit Tax.

There are currently no published regulations for IRC section 877A. The exit tax regime will be applicable from 1. You should calculate the Exit Tax.

Exit tax analysis is complicated. We can also guide you through the multiple steps in the Exit Tax return filing process. Tax advantages for residents without domicile 5 corporate tax after refund.

Tax residents who have become US.

Expat Tax Return Price Estimate Calculator Greenback Expat Tax

Renouncing Us Citizenship Expat Tax Professionals

What Is Form 8854 The Initial And Annual Expatriation Statement

What Are The Us Exit Tax Requirements New 2022

Exit Tax In The Us Everything You Need To Know If You Re Moving

How To Calculate Hypotax Eca International

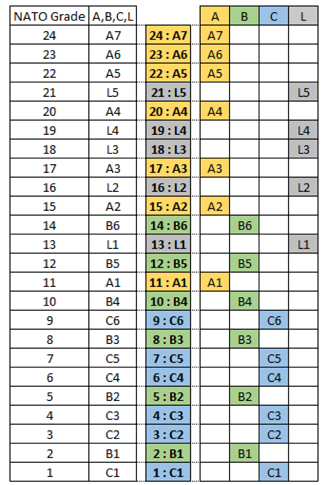

Nato General Information Working For Nato

Calculator Need To File Us Expat Taxes Myexpattaxes

Taxation Of Crypto Staking Sf Tax Counsel

What Is Form 8854 The Initial And Annual Expatriation Statement

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Us Exit Taxes The Price Of Renouncing Your Citizenship

What Are The Us Exit Tax Requirements New 2022

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

What Is Form 8854 The Initial And Annual Expatriation Statement