b&o tax rate

The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. Potential BO Tax 4710.

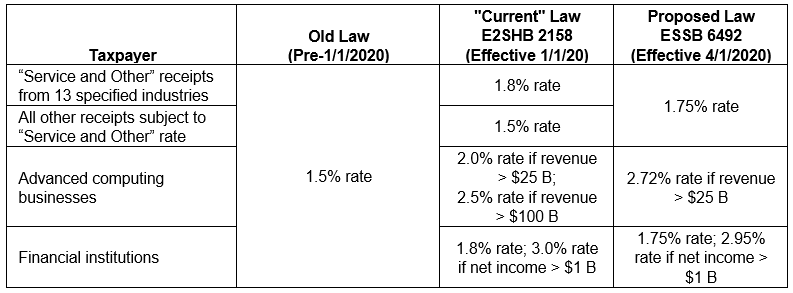

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by.

. Auburn 253 876-1923 0001 0001 00015 00018 500000. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. For retail businesses where the BO tax is based on gross receiptsincome the maximum tax rate may not exceed 02 of gross receipts or gross income unless approved by a simple majority of voters RCW 3521711.

Both Washington and Tacomas BO tax are calculated on the gross income from activities. Washington unlike many other states does not have an income tax. The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications.

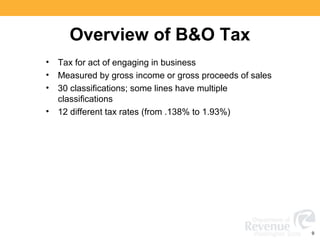

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Tax Rate Line 12 - The BO tax rate for the City is 110 of 1.

This guide provides a basic description of Kents BO tax. The City of Bellingham BO Tax Rates are. The state BO tax is a gross receipts tax.

Effective April 1 2020 the BO tax will be imposed at two separate rates under the Service and Other Activities classification. The present tax rate is 01 0001. However the law allows cities that had a.

Local business occupation BO tax rates. Taxpayers conducting multiple activities may need to report in more than one tax classification. BO Tax Returns must be filed quarterly.

Service providers such as CPA firms architects attorneys and doctors those who do not normally pay sales tax fall into the 210 of 1 rate. Washington State BO tax is based on the gross income from business activities. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax.

Income from exempt activities need not be listed on the B O tax return. Be careful in calculating the tax owed. Service industry businesses have the heaviest tax burden with a tax rate of 15 more than triple the other major classifications.

The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes. If a taxpayer had taxable income of 1 million or more in the prior calendar year they will be subject to a 175 BO tax rate. How much is the BO tax.

If a due date falls on. It is measured on the value of products gross proceeds of sale or gross income of the business. B O Tax.

Multiply the Total Taxable Amount by 0001. It is measured on the value of products gross proceeds of sales or gross income of the business. For example for a taxable gross revenue amount of.

Algona 253 833-2897 000045 000045 000045 000045 10000 40000. Business Occupation Taxes. Penalties and interest are due if tax forms are not filed and taxes are not paid by the due date.

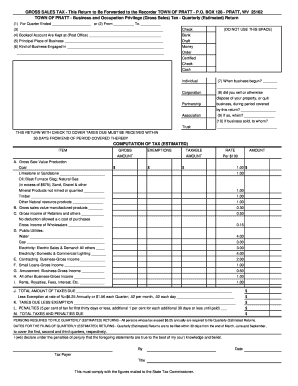

All businesses located in the Village of Barboursville must fill out the Business and Occupation BO Tax Return. Classification Tax Rate 0471. The rate of taxation is not uniform for all businesses.

BO TAX RATES Based on Gross Receipts Extracting 0017 Manufacturing 0017 Retailing 0017 Wholesaling 0017 Services and other activities 0044 BO TAX SCHEDULE Tax returns must be filed for each period even if no tax is due. You will list all gross income for the appropriate filing period on the return. B O tax rates When paying the B O tax to the Department of Revenue you declare your.

Items claimed as dedu. Although there are exemptions every person firm association or corporation doing business in the city is subject to the BO tax. Any license fee or tax due and unpaid and all interest and penalties thereon are considered a debt to the City and may be collected in the same manner as any other debt.

Washington unlike many other states does not have an income tax. Business and Occupation Tax Rate. Washingtons BO tax is calculated on the gross income from activities.

The applicable BO tax rate depends on the type of business activity. Aberdeen 360 533-4100 0002 0003 e 00037 e 0003 e 5000 20000. The BO tax was established effective January 1 2013 to pay for critical street repairs within the City.

Most businesses fall into the 110 of 1 rate including Retail Service such as restaurants and clothing stores. This means there are no deductions from the BO tax for labor. The gross receipts BO tax is primarily measured on gross proceeds of sales or gross income for the reporting period.

100000 the business pays 100. Seattle is currently the only city with a voter-approved BO tax higher than 02. In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO tax unless a specific retail sales tax deduction or exemption applies.

This is multiplied by your gross receipts to compute your taxes due. Filing periods end on. Rather different types of businesses are taxed at different rates depending upon their classification by the Washington State Legislature and the Washington State Department of Revenue.

There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year. The City Business Occupation BO tax is a gross receipts tax.

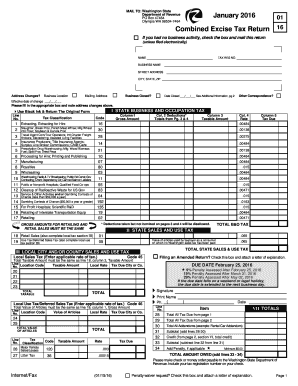

B Amp O Tax Return City Of Bellevue

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

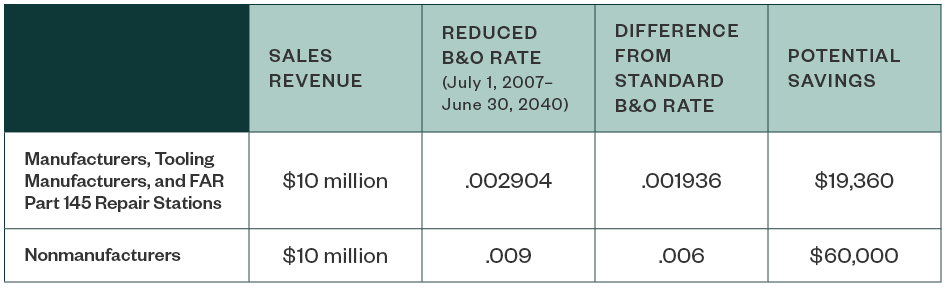

Washington Aerospace Tax Incentives

B Amp O Tax Guide City Of Bellevue

Business License Tax Seattle Business And Occupation Tax B O Tax Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll

Iata Resolution 788 Eligibility Form Fill Out And Sign Printable Pdf Template Signnow

Wei Combined Excise Tax Return Form Fill Out And Sign Printable Pdf Template Signnow

Business Occupation Tax Clarksburg Wv

Why Our B O Tax Is Unfair R Seattlewa

Washington State Sales Use And B O Tax Workshop

Business And Occupation B O Tax Washington State And City Of Bellingham