arizona solar tax credit form

Starting in 2020 the value of the tax credit will step down to 26 and then again to 22 in 2021. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability.

1 Best answer.

. Neither Solar Concepts Redilight QuietCool or any product manufacturers are tax consultants. The maximum incentive for any system is 2 million per year and the annual budget for the program is 20 million. Form 315 6 00 7 Credit for Solar Hot Water Heater Plumbing Stub Outs and.

This means that in 2017 you can still get a major discounted price for your solar panel system. The 30 tax credit applies as long as the home solar system is installed by December 31 2019. Residential Arizona solar tax credit.

Photovoltaic PV and wind energy systems 10 kilowatts kW or less can receive an upfront rebate of 005 per watt up to 500. The federal ITC remains at 26 for 2022. This is a personal solar tax credit that reimburses you 5 of the cost of your solar panels up to 10001000 maximum credit per residence irrespective of the number of energy devices installed.

State solar income tax credit. Some common tax credits apply to many taxpayers. Compare solar quotes on the EnergySage Marketplace to maximize your savings.

An income tax credit for the installation of solar energy devices in Arizona business facilities. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability. Get Pricing Calculate Savings.

Form 344 is an Arizona Corporate Income Tax form. Arizona Residential Solar Energy Tax Credit. The credit is up to 1000 so if.

This credit comes off of your taxes in the year you install your system. Arizona has the Arizona Solar Tax Credit. Residential Arizona Solar Tax Credit of 25 up to 1000 off your personal state income tax.

A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona. To claim the solar tax credit youll need to first determine if youre eligible then complete IRS form 5695 and finally add your renewable energy tax credit information to Schedule 3 and Form 1040. The Renewable Energy Production Tax Credit is applied for using Arizona Form 343.

Form 310 is an Arizona Individual Income Tax form. Find Top Rated Solar Programs in Your Area. The Arizona tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. However unlike the federal governments tax credit incentive Arizona tax credits have a limit. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

After 2021 the tax credit for residential solar. Energy Equipment Property Tax Exemption. Phoenix AZHomeowners who installed a solar energy device in their residential home during 2021 are advised to submit Form 310 Credit for Solar Energy Devices with their individual income tax return and Form 301 Nonrefundable Individual Tax Credits and Recapture.

Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes. This form is for income earned in tax year 2021 with tax returns due in April 2022. 23 rows Did you install solar panels on your house.

25 of the gross system cost up to a maximum of 1000. A solar energy device is a system or series of mechanisms which collect and transfer solar. The tax credit remains at 30 percent of the cost of the system.

If you have any further questions regarding taxes consult a tax professional. We last updated Arizona Form 310 in March 2022 from the Arizona Department of Revenue. Ad Enter Your Zip Code - Get Qualified Instantly.

This incentive comes right off of your income tax for the same year you install the solar system. Or Form 140PY line 60. More about the Arizona Form 310 Tax Credit.

Check Rebates Incentives. This credit can give you a reimbursement of up to 25 of the cost of your solar panels so you can spend less and get the installation you want. We will update this page with a new version of the form for 2023 as soon as it is made available by the Arizona government.

June 6 2019 1029 AM. Equipment and property tax. Arizona Department of Revenue tax credit.

1000 personal income tax reduction 6. Arizona Department of Revenue 602 255-3381 1600 West Monroe Street Phoenix AZ 85007. The federal tax credit falls to 22 at the end of 2022.

32 Family Income Tax Credit from Form 140 line 50. To claim this credit you must also complete Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture and include both forms with your tax return. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

Their tax credit incentive will let you deduct 25 of the cost of your solar energy system from your state income taxes. Residential Arizona Solar Tax Credit. According to our market research and data from top solar brands the average cost of solar panels in Arizona is 261 per watt of solar capacity which means a 5-kW system costs around 13050 before incentives.

That can help you protect the planet and you wont need to pay as much to get started. The incentive amount for Wind and Biomass is 001kWh paid for 10 years. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits.

This is 26 off the entire cost of the system including equipment labor and permitting. Energy Equipment Property Tax Exemption. Solar water heating systems can receive a rebate of 050 per kilowatt-hour kWh of estimated energy savings in the first year.

We last updated Arizona Form 344 from the Department of Revenue in May 2021. There are several Arizona solar tax credits and exemptions that can help you go solar. State sales tax exemption.

The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022. You can only claim up to 1000 per calendar year on your state taxes. An Arizona income tax credit is offered to businesses that install one or more solar energy devices in their Arizona facilities.

Form 301 and its instructions for all relevant tax years can be found at. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

It is a 25 tax credit on product and installation for both 2020 through 2023. This information is provided as general knowledge. Solar energy systems are exempt from the states 56 sales tax and some cities and local governments also exempt solar equipment from their city privilege sales taxes saving an additional 0.

This is claimed on Arizona Form 310 Credit for Solar Energy Devices. Here are the specifics. The state sales tax of 56 does not apply to solar equipment.

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. Or Form 140X box 40a. The 25 state solar tax credit is available for purchased home solar systems in Arizona.

Summary of solar rebates in Arizona. Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture 2021. Worth 26 of the gross system cost through 2020.

Image Credit Copyright Adam Block Mount Lemmon Skycenter University Of Arizona Http Skycenter Arizona Edu Gallery Galaxie Spiral Galaxy Galaxy Art Galaxy

The Mystery Of Stonehenge Ancient Petroglyphs And Crop Circles Petroglyphs Ancient Aliens Electric Universe

Revolving Credit May Pose Next Risk Wsj Poses Risk Credits

Saudi Arabia Makes Next Solar Move Power Technology

Schools Are Saving With Solar On Day One With Our Solar Leasing Program Residential Solar Solar Panels Solar Energy Companies

Tips For Finding Big Savings Around The House Living On A Budget Piggy Bank Budget Saving Living On A Budget

Solar Energy With Sunset Glow Solar Energy Panels Solar Energy Diy Solar

California Solar Incentives And Rebates Available In 2022

How Big Is The Universe S Largest Galaxy Really Galaxy Spiral Galaxy Virgo Cluster

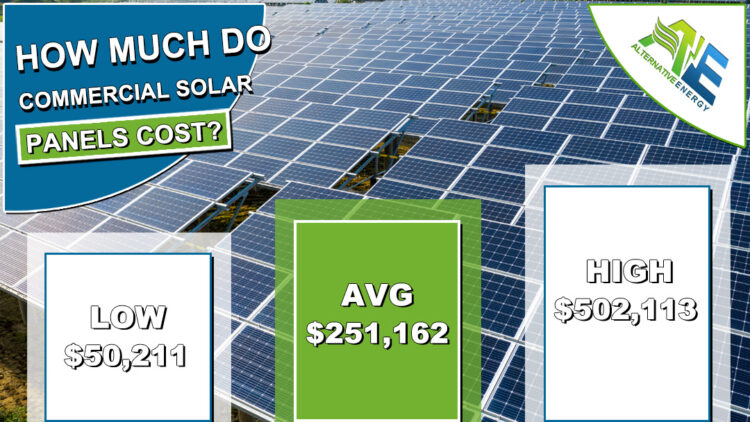

Commercial Solar Panels Cost 2021 Average Prices

Total And Ignis To Develop 3 3gw Solar Power Projects In Spain Power Technology

Back To Back Sun Storms May Supercharge Earth S Northern Lights Space And Astronomy Earth And Space Science Astronomy

Ucc1 Financing Statement Security Finance Birth Certificate Florida Department Of Health

Prophecy Stone From Egypt Strengthen Your Instinct Etsy Prophecy Orgonite Stone

Solar Trends Sustainable Energy The Most Mentioned Term On Twitter In Q1 2022

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Illinois Tax

Florida Solar Incentives Tax Credits Guide 2022 Palmetto

Salmonella Poses A Triple Threat Ranging From Food Poisoning To Lethal Infection Salmonella Food Poisoning Triple Threat