unfiled tax returns 10 years

CA and NY will probably still be. The CRA voluntary disclosure program VDP only applies to the last 10 years of tax issues such as unfiled tax returns or unreported income or offshore assets not reported on a form T1135.

Unfiled Tax Returns Attorney In Mo Saint Louis Mo Tax Law Attorney Michael Krus

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances.

. After the expiration of the three-year period the refund statute prevents the issuance of a refund check and the application of any credits including overpayments of estimated or withholding taxes to other tax years that are underpaid. There is no statute of limitations on unfiled returns. Also most delinquent return and SFR enforcement actions are completed within 3 years after the due date of the return.

My friend asked for help with her tax returns has never filed. The clock starts ticking when you file a return or the IRS assesses a tax against you. The statute of limitations for the IRS to collect taxeswhich is generally ten yearsalso doesnt begin until you file your return.

If you dont file your return within three years of the due date you forfeit your right to the refund money and the IRS wont even use this money toward any balance you. 10 years of unfiled tax returns. Repeated late filing penalties increase the penalty rate to 10 for that year plus 2 per additional month you file after the due date to.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for each full month your return is late to a maximum of 12 months. The IRS can legally pursue you for unpaid taxes 10 years after filing your return and taxes being assessed.

On top of the late filing penalty therell be a failure to pay penalty. You might be filing things that do not need to be filed. However they can still come after you for any unpaid taxes that you may owe.

In almost every case we see no you do not need to file every year. She has never made more than 20k on paper. FS-2020-02 February 2020 The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further enforce the law.

The IRS may ask you to file returns that are older than six years old. The refund is held for 6 months while the IRS requests a filed return from the taxpayer. There might be a lot of debts that already have expired especially with the IRS.

When you file tax returns late youll always have penalties assessed against you. First what NOT to do on more than 20 or more years of unfiled tax returns. If no return is received an assessment may be made through the Automated Substitute for Return.

Part of the reason the IRS requires six years is manpower the IRS cannot administer and staff the enforcement of unfiled tax returns going back as far as 10 or 20 years. If you havent filed a return the IRS can go back to any time period and assess a tax against you. Every year taxpayers fail to file and let the IRS hold their money interest-free.

The IRS and state might have already come up with a lower balance for you. Yes if the IRS identifies that the taxpayer has an unfiled prior year return especially a return in which the IRS projects a balance owed they can freeze the refund and request the taxpayer to file. However in practice the IRS rarely goes past the past six years for non-filing enforcement.

In addition the IRS is increasing the use of data analytics research and new compliance strategies including personal visits to reach taxpayers and tax return preparers. The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118. The IRS has an unlimited amount of time to access unfiled tax returns.

10 years of unfiled tax returns. If you owed 10000 in taxes youll have a penalty of 2500 just for failure to file. Take A Head Count Of.

445 18 votes. However once the tax has been assessed the IRS only has 10 years to collect. Posted by 3 years ago.

Filing a Bankruptcy an Offer in Compromise or a Collection Due Process hearing will. How often do you spend 2500 on anything. The IRS generally wants to see the last seven years of returns on file.

After that the IRS can no longer prosecute you for not filing your taxes. Technically speaking taxpayers should keep their tax records for a long period of time maybe even forever but in practice the IRS really doesnt go back more than six years when enforcing filing requirements. And believe it or not the IRSs records rarely if ever go.

There are however things you can do that will toll the statutes. Most years are refunds some years didnt have enough. She works in the service industry with one main job a 1099 some years and cash side gigs.

Even if you cant afford to pay off your full tax bill right now you should file your delinquent returns right away. Tax returns for prior years will have a penalty of 25 of the taxes due just for failure to file. The reason is that CRA administers voluntary disclosure program VDP and the ability to waive or cancel.

If you have not filed a return and its been more than three years since the return was due its best to file as soon as possible to avoid any penalties or fines. Voluntary Disclosure if More than 10 years Outstanding Calgary Tax Lawyer Analysis. That means the IRS has more time to seize your assets for unpaid taxes.

If youre getting refunds and wont owe taxes you can focus on the last four years only as the statute. If the IRS filed for you youll want to replace the Substitute for Returns with returns of your own to reduce the balance they assessed. The statute of limitations on unfiled federal tax returns is three years.

Do not go to a CPAEA and just file all the unfiled tax years.

Unfiled Tax Returns What To Do Tax Problem Solver

Irs Letter 5972c You Have Unfiled Tax Returns And Or An Unpaid Balance H R Block

How Long Should You Worry About Unfiled Tax Returns Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

How Far Back Can The Irs Collect Unfiled Taxes

How Far Back Can The Irs Go For Unfiled Taxes

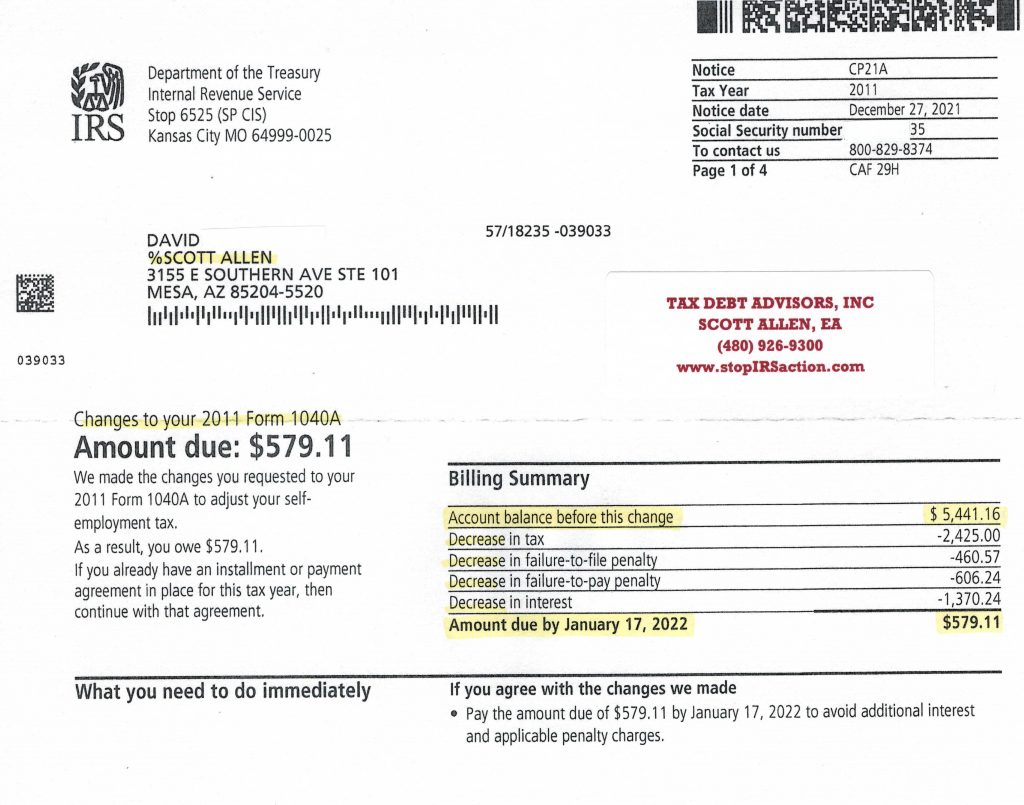

Back Tax Returns Tax Debt Advisors

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Tax Returns Premier Tax Solutions

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Have Unfiled Tax Returns Here Are A Few Ways A Tax Attorney Can Help

Unfiled Tax Returns Tax Champions Tax Negotiation Services

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Unfiled Tax Returns Mendoza Company Inc

Irs Notice Cp515 Tax Return Not Filed H R Block

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson